- admin

- 27.02.2024

- No Comments

- News

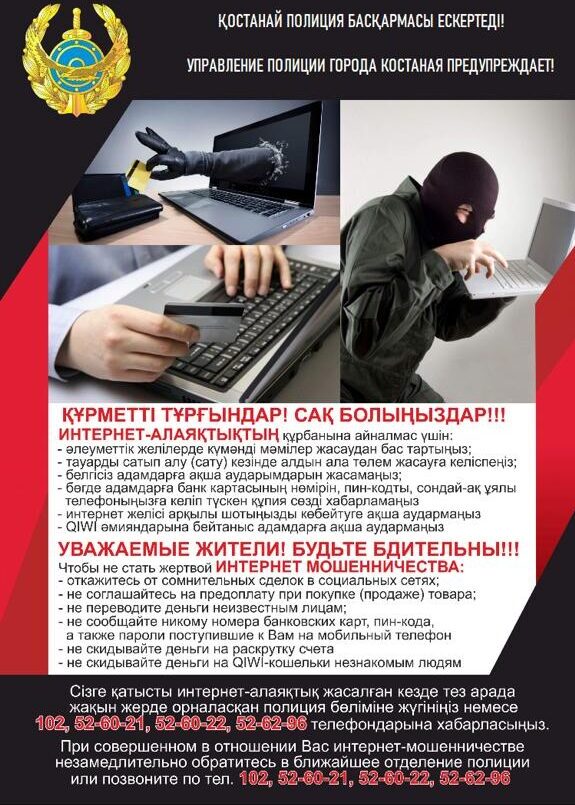

With the development of modern technologies, the number of fraudulent activities using mobile communications and bank cards has increased.

On February 27, 2024, the senior inspector of the UMPS DP of the Kostanay region, police major Nursaitov T.S. and the detective officer of the OKP of the city of Kostanay, police captain A.M. Islambekov told citizens about the most common methods of fraud, as well as how to protect themselves from criminal attacks.

Police Major Timur Nursaitov focused the attention of those present that scammers can pose as employees of law enforcement agencies, credit organizations, social services and other government agencies and private organizations. Still one of the most popular is the deception scheme, when scammers call on behalf of the bank, scare with loans allegedly issued without the client’s knowledge, or report other problems with savings, forcing the victim to hand over confidential data or make a transfer to a certain “safe account.”One of the most common scams is the message that “your relative was in an accident.” To release a relative from criminal liability, a certain amount of money is required. Putting the intended victim into a “stupor” from the tragic news, and sometimes even speaking on behalf of a relative or a police officer, they ask for urgent financial assistance to quickly resolve the problem.Police captain Islambekov Abylay noted that attackers often act according to a clearly planned program.If any official or employee of an organization calls you on the phone, find out their title or position, last name, first name, patronymic, ask for time to think about it. If the voice on the phone sounds similar to that of your loved one, ask him a couple of personal questions. It is usually not profitable for scammers to comply with such requests, because then they risk being exposed.Police officers also emphasized that sometimes young people are involved as dummies who, for a small fee, allow fraudsters to use their bank cards. These include those who withdraw money from other people’s cards at ATMs, and those who give their cards to buyers. Often, criminals recruit minors as droppers, who sign up for bank cards and hand them over to buyers for little money. These cards are then used in fraudulent schemes. Money stolen from citizens is transferred to the cards, and droppers withdraw them or transfer funds to other cards.Abylay Malikuly also spoke about the articles of the Criminal Code of the Republic of Kazakhstan and what punishment these articles provide for committing fraudulent actions or participating in them.At the end, all participants of the meeting were asked to formulate rules that would help protect themselves, as well as their savings, from scammers. Students actively asked questions and formulated safety rules.

The article was prepared by social educator Morgunova E.A.